By: GoldCore

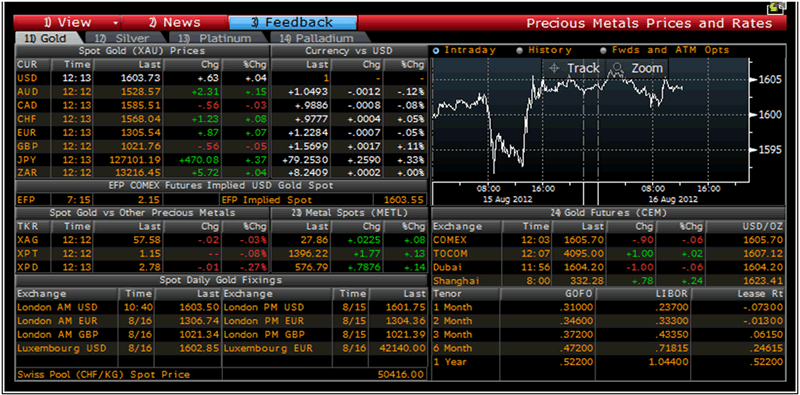

Today's AM fix was USD 1,603.50, EUR 1,306.74, and GBP 1,021.34 per ounce.

Today's AM fix was USD 1,603.50, EUR 1,306.74, and GBP 1,021.34 per ounce.

Yesterday?s AM fix was USD 1,594.75, EUR 1,293.60 and GBP 1,016.74 per ounce.

Silver is trading at $27.91/oz, ?22.81/oz and ?17.85/oz. Platinum is trading at $1,401.00/oz, palladium at $574.40/oz and rhodium at $1,075/oz.

Gold rose $4.50 or 0.28% in New York yesterday and closed at $1,604.10/oz. Silver edged off and recovered to a high of $27.99 and finished with a gain of 0.07%.

Gold is floating in a tight range at $1,600/oz today and gold continues consolidating at this level.

The macroeconomic backdrop remains highly supportive with the Eurozone debt crisis far from resolved and the risk of debt crisis in Japan, the UK, India, China and the U.S. in the coming months.

US data reported yesterday clouded any certainty over the US need for imminent quantitative easing. However it is certain that the hawks and doves will have much to discuss at the upcoming Jackson Hole Economic Policy Symposium at the end of the month.

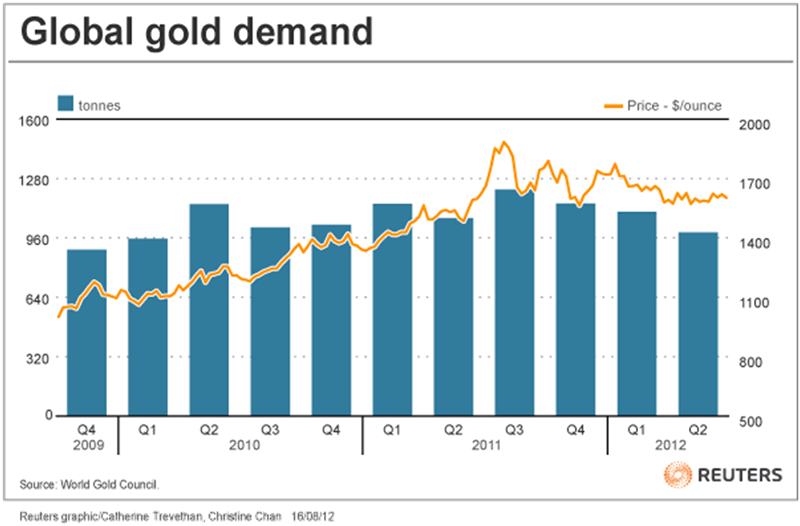

The World Gold Council released its quarterly report today, Q2 2012 Gold Demand Trends Report and can be read in full on the World Gold Council website here.

Accumulation of gold bullion from central banks was the bright spot in demand last quarter, as total demand fell 7% globally, which was driven by a 38% fall in consumer demand from India.

Price sensitive Indians have been shunning gold and many have been opting for far cheaper poor man?s gold ? silver.

Jewellery and investment demand both fell. Jewellery consumption was down 72.3 tonnes at 418.3 tonnes, while investment fell 88.3 tonnes to 302 tonnes.

The report shows how while record levels of demand from western markets, China and particularly India have been followed by a decline ? the seismic shift that is central banks going from being bet sellers to net buyers has provided a new fundamental pillar of support for the gold market.

Physical demand slowed down in western markets and especially in India in recent months but large buyers continue to accumulate - both hedge funds and central banks and this is providing fundamental support to gold above the $1500 to $1,600/oz level.

2Q total central bank gold purchases were double the level reported a year ago as emerging market sovereign nations sought to diversify away from the dollar and euro and heightened economic insecurity.

Gold purchases among central banks hit its highest quarterly levels (157.5 metric tons) since the sector became a net buyer of the yellow metal in 2Q 2009.

The official sector which comprises central banks and other official institutions had by comparison bought 66.2 tons in 2Q 2011.

If central banks continued to purchase gold at the current rate the official sector gold take would total nearly 500 tons this year, topping the 458 tons purchased in 2011 by the sector.

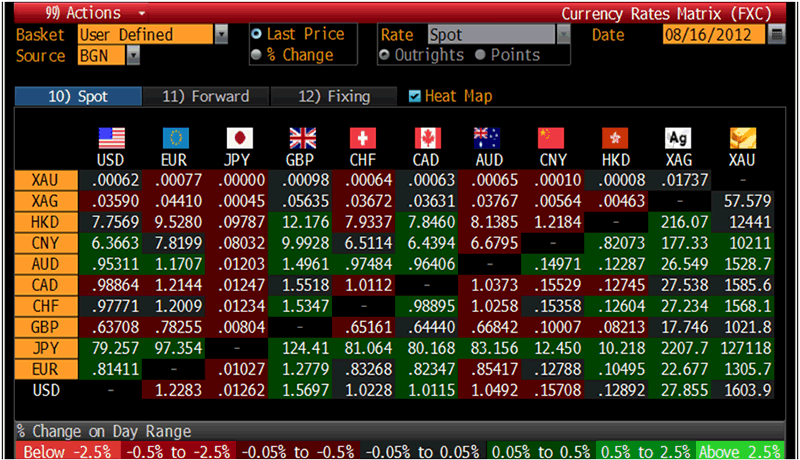

Cross Currency Table ? (Bloomberg)

Central banks have become net buyers of the yellow metal increasing their reserves as a hedge against the sovereign debt crises affecting the euro and dollar. Prior to 2009, central banks had been net sellers of gold bullion for nearly 20 years.

Central banks of Russia, Saudi Arabia, Mexico, Turkey, Kazakhstan, Thailand, Ukraine and the Philippines have been recently active buyers of gold.

Kazakhstan's central bank purchased gold for its 7th month in a row this June, rapidly growing its reserves which are now 1 million troy ounces higher than last year, according to International Monetary Fund data.

There is the potential of greater demand from unreported purchases by the People's Bank of China - should they decide to again report an increase in their gold holdings.

The global banking, financial and monetary system is, to put it frankly, a mess and will take years to rectify - in the meantime gold looks set to continue gradually eking out safe haven gains.

Global gold demand is back at levels seen in 2009 which shows that the assertion that there is a gold bubble mania with ?Joe and Jane public?, the investment and non investment world ?piling into? gold is far from the case.

Gold Prices/Rates/Fixes /Volumes ? (Bloomberg)

As a percentage of pension and investment portfolios and of central bank currency reserves gold allocations remain miniscule from a historical basis and miniscule when compared to allocations to more risky equities and bonds.

This suggests that the gradual increase in demand and then slight decline in demand since Q3 2011 is nothing more than then ebb and flow and is sustainable. There is a possibility that the gradual increase in demand in the coming years could give way to a more substantial increase in demand in the future.

Given the appalling fiscal and monetary backdrop, demand for gold, particularly from investors and store of wealth buyers will likely increase significantly in the coming years ? as gold gradually goes from a its status as a fringe investment back to being a mainstream asset common in all investment portfolios and owned by the majority of investors and savers.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL E info@goldcore.com |

UK |

IRL +353 (0)1 632 5010 W www.goldcore.com |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

? 2005-2012 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Source: http://www.marketoracle.co.uk/Article36077.html

magic johnson jetblue pilot solicitor general neighborhood watch dennis rodman dodgers sale tami roman

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.